75% of trades in the world are executed by bots.

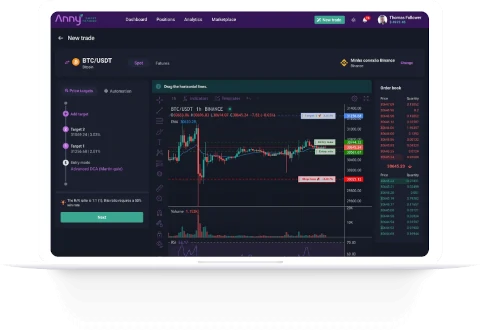

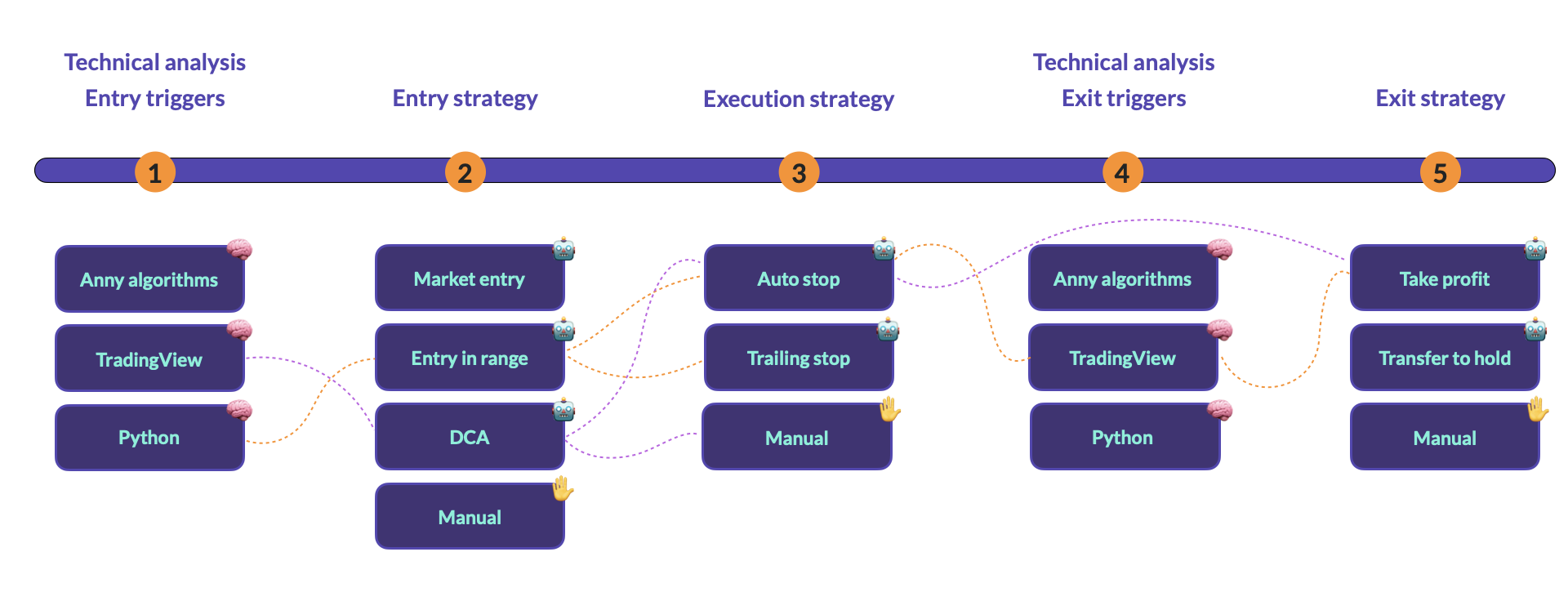

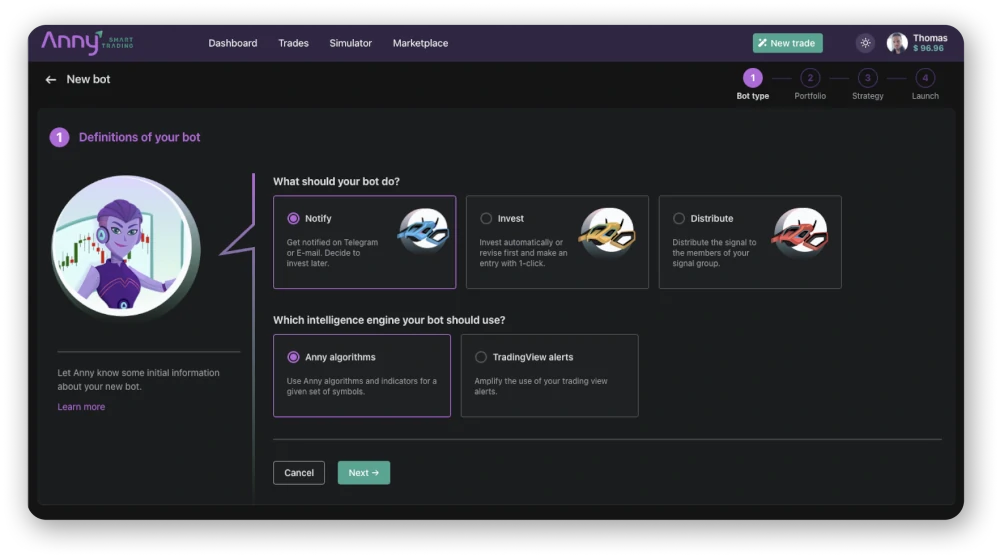

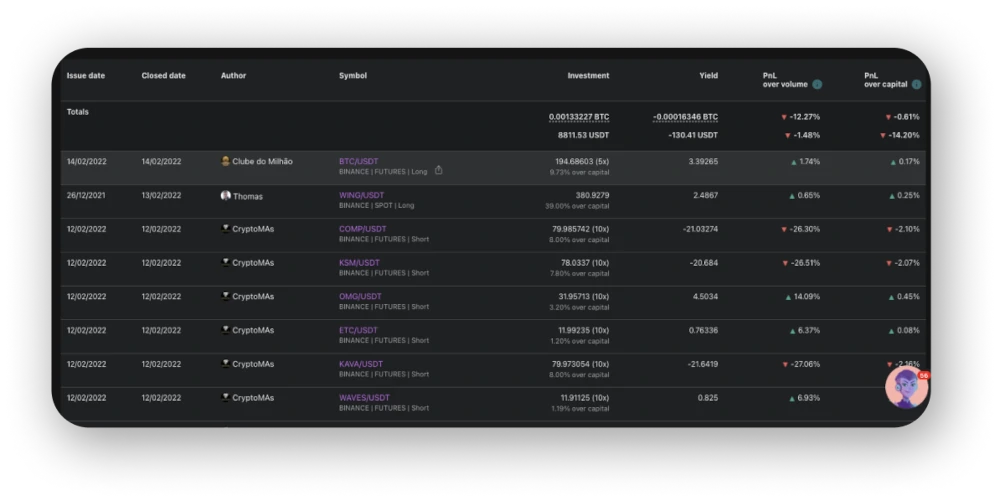

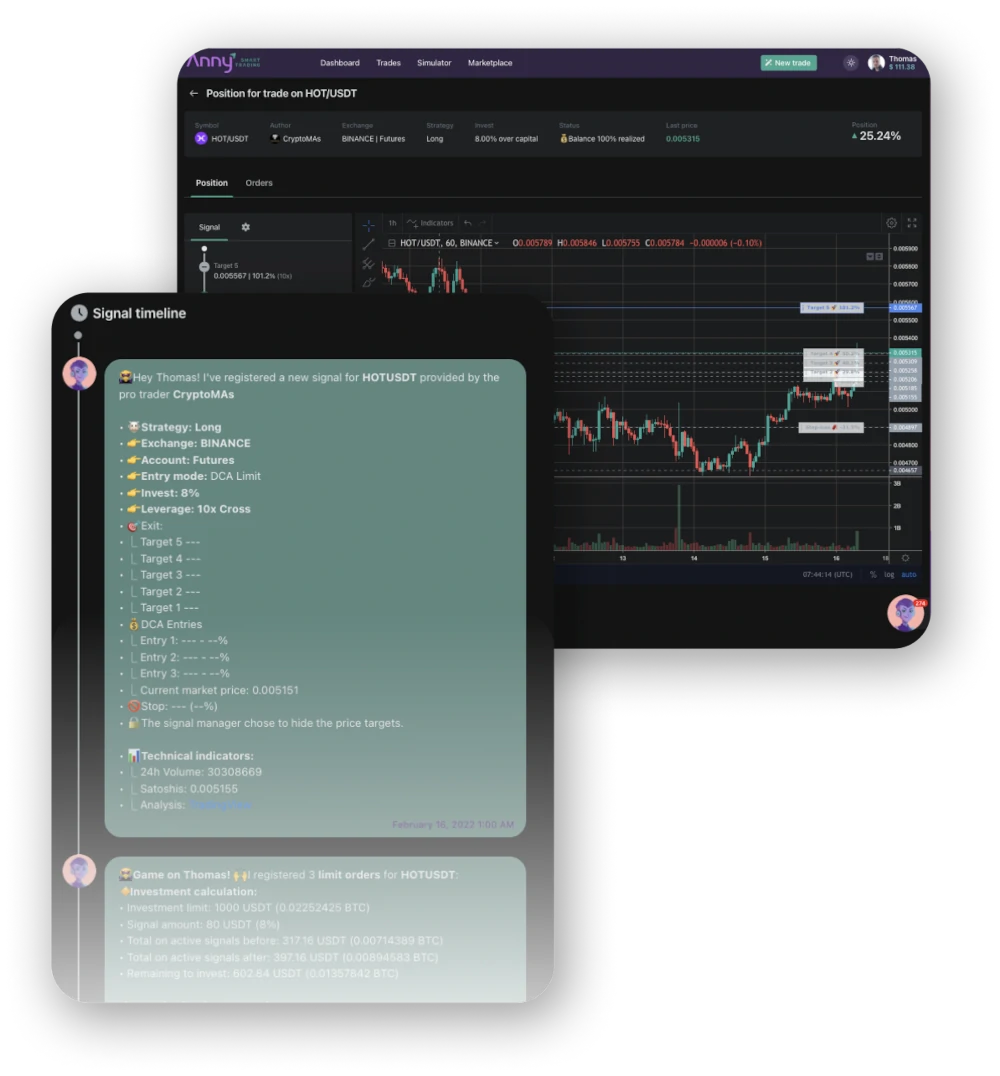

Unlock the power of Anny's next-gen smart trading. Automate your crypto investments with AI-driven bots, real-time market insights, and advanced risk management. Join thousands of users optimizing strategies across Binance, Kraken, Coinbase, and more.